Written by

HO Chi-ping Patrick

LUFT, Gal

Image Source:Internet

Since its invention, money has had to fulfill two roles: it is a way to store value and it is a medium of exchange. In other words, whether it is a silver coin, an ounce of gold or a green piece of paper saying “In God We Trust” it must be acceptable to everyone, because everyone believes that it can be exchanged for something of value whether it is a cup of coffee or a movie ticket.

Perhaps the biggest revolution in monetary affairs was the transition from representative money — cash that is backed typically by a precious metal like gold or silver — to fiat money. Under a system governed by representative money, the amount of money issued to the public must always correspond to the amount of precious metals in the issuer’s vault.

Image Source:Internet

Fiat money, on the other hand, has no inherent value. It is simply created on a whim by a central government on faith and faith alone. It is widely used by the people simply because we are conditioned to believe that no matter what, the government, with all the powers behind it, will always guarantee its value. The dictum printed on every American dollar could be more appropriately interpreted to mean “In Government we trust”!

The transition from representative money to fiat money has accelerated in the past half century since the United States, in 1971 under President Nixon, withdrew from the Gold Standard, essentially de-linking the value of the dollar from gold. The U.S. government was no longer obligated to limit its money supply. It issued more and more money in the form of dollar denominated financial instruments, and the world has always been there to absorb them. Since then, the United States have opened the floodgates, taking advantage of the hollow nature of fiat currencies with impunity.

Image Source:Internet

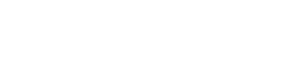

There have been reports that this upcoming 15th Summit of leaders of BRICS countries in Johannesburg will consider and discuss rolling out a new gold-backed currency, to reverse the trend from faith-based money back to a value-based one. For this to happen, this new currency needs to be physically backed by gold as well as a new payment system to support it. In other words, BRICS would have to create a Gold Standard 2.0 where members will be able to trade, and while the road to implementation is long, there are some signs that BRICS members and their allies may already be moving in this direction.

The idea of a new currency again backed by gold is not new. In the wake of the 1997 Asian financial crisis, Malaysia’s Prime Minister Mahathir Mohamad promoted the idea of an Islamic Gold Dinar to become a legal tender of financial exchange in the Muslim world. The idea did not go far, and Mahathir left office in 2003. But in 2018, when he came back to power as the world’s oldest leader, Mahathir began to promote a new vision for a gold currency, this time a Pan-Asian alternative currency to be used among Asian countries in order to avoid the so-called “dollar trap.”

Image Source:Internet

The big question is whether BRICS countries and potential members like Malaysia and Indonesia can beef up the gold reserves in the vaults of their central banks to the level needed to back up a common currency or a basket of currencies. This would require the buildup of a gigantic amount of gold at least equivalent to, or near to, the 8,133 tons presently held by the United States, the world’s largest owner of gold. Currently, the official gold reserve of all five BRICS countries is just about 5,452 tons. Still a way to go.

But keeping an eye on the gold market is incredibly important in this day and age. Since the sanctions on Russia were imposed, the Kremlin’s central bank has been the number one gold buyer, bringing Russia’s total reserves to over 2,330 tons. India is also building up stocks of the yellow metal. As always, the wild card is China.

Image Source:Internet

China’s official gold reserves have reportedly grown from 1,054 tons in mid-2015 to 2,113 tons in 2023. But there are reasons to believe that China’s real reserves are far larger than the “official” ones, as many transactions on the Shanghai Gold Exchange are Over the Counter (OTC), and hence may not reported. On its face, China only keeps a small portion of its foreign exchange reserves, roughly two percent, in gold compared to countries like the U.S., Germany, France and Italy, where gold’s share of national reserves is over 60 percent. So, it makes perfect sense for China to increase its reserves especially in light of its desire to increase its credibility with the IMF and to enhance the international status of the yuan. But China’s official numbers as presented to the world every several years by its State Administration of Foreign Exchange (SAFE) have been considered to be understated. The scope of its true reserves is the biggest mystery of the world economy, and the answer to this enigma could have a huge impact on its, and the world’s, future.

Various experts who keep track of China’s gold market, and who attempted to estimate China’s actual gold reserves using different methodologies, came up with figures ranging from 4,000 tons to 10,000 tons with an additional 10,000 tons held by the Chinese public. In other words, the general view is that China owns more gold than France, Italy, Germany and perhaps even the United States. The reason experts are skeptical about China’s 2,113 tons claim is that China is the number one gold producing nation (South Africa, another BRICS member, is number two) and for the most part its production – China’s annual gold output is roughly 450 tons – remains in the mainland. In addition, it is widely claimed that the People’s Bank of China (PBOC) has been buying roughly 500 tons of gold per year since 2009 and much of the buying has been through covert operations.

Image Source:Internet

James Rickards describes in his book The Death of Money an eye witness testimony of a senior manager at security firm G4S who had participated in an undercover People’s Liberation Army (PLA) supported logistical operation to transport a substantial volume of gold into China via central Asia. Another reason for the skepticism about China’s official reserves is that, unlike in Western economies where gold is held by the central bank, it is believed that in China much of the government’s gold is held outside the control of the PBOC, for example with the military and other organs of the Chinese government. The Chinese never keep all their eggs in one basket. In other words, we may be getting the truth about the PBOC reserves but there may be other PBOC-like deposits which hold most of China’s gold.

Image Source:Internet

Revealing its true gold reserves would be out of the question for the China as it could cause enormous disruption in the world economy. News that China has thousands of tons of never-spoken-of gold would send gold prices to historical highs and this would have a hugely destabilizing impact on financial markets. It would also significantly strengthen the yuan against the dollar which would severely hurt China’s export-oriented economy. Furthermore, the PBOC has huge dollar holdings which could lose significant value should China reveal its true gold holding. Additionally, if China comes clean about its gold holdings this would be a direct head-on challenge to American supremacy. China is not quite ready for that yet. It may be in the future, when the Sino-US situation calls for such a final show-down.

China’s true gold reserves may therefore be the economic equivalent of a nuclear bomb in the basement. When the secret is revealed, the world economy will never be the same.

Edited by Fang Fang

Proofread by Wang Yan