Written by :

Dr. HO Chi-Ping, Patrick

Dr. LUFT Gal

Image source: Internet

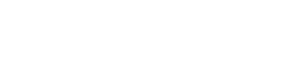

International institutions and global citizens are increasingly fed up with U.S. extraterritorial jurisdiction. Especially since 2010, many have been seriously affected by the U.S. Foreign Account Tax Compliance Act (FATCA), a controversial law requiring all non-U.S. financial institutions throughout the world to search their records for customers who are U.S. citizens or residents and to report the assets and identities of such persons to the U.S. government.

Foreign banks, no matter where they are situated, that dared to refuse the U.S. government on the grounds of banking secrecy were notified that they would not be able to operate in the U.S., a poison pill to any respectable financial institution. It also requires U.S. persons to self-report their non-U.S. financial assets annually to the U.S. Internal Revenue Service (IRS). Other than Eritrea, the United States is the only country in the world which places citizens who live in foreign countries under its domestic tax law. All other countries tax people based on the place of their residency —not their citizenship.

Image source: Internet

FATCA aimed to fight money laundering, terrorism finance, tax evasion and other nefarious activities that occasionally occur under bank secrecy. It also promised to enrich the federal government by as much as $800 million in outstanding taxes. But like everything in life, zealous enforcement brings unintended consequences. FATCA created a huge wave of resentment not only among the nine million U.S. citizens living abroad but also among banks and other financial institutions worldwide. The receivables came nowhere near the promised $800 million but instead imposed billions of dollars in compliance costs and accounting fees that were rolled over to innocent customers at large, and passed onto financial institutions as intensified due diligent obligations incurring additional operating costs, and perhaps eating into their profits.

So intrusive is FATCA that U.S. persons living abroad who have signing authority on foreign accounts or assets belonging to aging parents or disabled relatives or who are partners in foreign businesses must report on those accounts to the IRS in the U.S. even if their parents or business partners have nothing to do with the United States. The fines for non-compliance are draconian and so are the accounting costs imposed on those expatriates.

Image source: Internet

Very few policies have caused as much international resentment of the United States as FATCA. It subjects holders of U.S. citizenship abroad to unfair treatment like double taxation, prohibitive compliance costs and other hardships including difficulties in opening bank accounts. Foreign banks have no choice but to conform to American demands and rules. Failure to comply would effectively result in exclusion from the U.S., and by extension the international, financial system. This is a powerful stick. Fearing the high compliance costs and draconian fines imposed by the U.S. government for various FATCA violations, foreign banks are now viewing customers with ties to America as if they were deadly enemies of the U.S. Government. Many prefer to simply not deal with Americans. It would not be an exaggeration to say that is easier for an Iranian passport holder to open a bank account or to issue a credit card in Switzerland than it is for a U.S. passport holder. Worse, to protect themselves from any possible mishap, foreign banks are closing the accounts of clients who have never thought of themselves as Americans but may have an American parent or some remote tie to the U.S. that makes them de jure U.S. citizens. A 2016 BBC segment featured Fabien, who was born in the United States and whose father brought him to Europe when he was a baby. He described his surreal situation: “I live in France; I work in France; my life is in France. I have no link to the United States. My life as a Frenchman is in France. I don’t even speak English!” Yet, this accidental American cannot open a bank account or conduct normal business activity in his country of residence, France, just because he was born in the U.S. And this story flies in the face of those who struggle so desperately to go to and give births in the U.S. so that their children can have American citizenship by birth.

Image source: Internet

This FATCA, besides subjecting everyone with any American ties whatsoever to possible draconian U.S. taxation requirements and related implications, also renders them unfavorable business partnerships in view of the risks of international enterprises falling into the nasty purview and unrelenting jurisdiction of the American law. Many international firms would hesitate to engage anybody with American ties in financial dealings as business collaborators, contributors, associates, or even as customers.

Image source: Internet

No wonder every year roughly 5,000 American citizens like Fabien choose to renounce their citizenship for fear of becoming casualties of the penal system of a country that is no longer their home—and will never be. The interesting thing about FATCA is that while the United States requires all other nations to share the fiscal information of their residents, it has refused to join the Common Reporting Standard (CRS) which was initiated at the G-20 summit in 2014 and which binds banks to share account information about assets with tax services of other countries. More than 110 countries have joined the CRS. The United States is the only G-20 member that has refused to join the standard. Banks throughout the world will have to report sensitive customers’ data to the U.S., but U.S. banks are not obliged to send their customers’ information to Governments of other countries. Is this another example of American exceptionalism or just hypocrisy to the core? Everybody else in the world should do what the American says, but the Big Brother can do anything and otherwise, even to the contrary to what it preaches. The result of this perverse situation is that foreigners holding their assets in the United States may be much more protected than Americans holding their assets abroad. No wonder droves of corrupted foreign officials and tycoons from overseas would choose to hide their assets in banks in the U.S. and not in their own countries. This may be lucrative for the United States’ financial sector but the reputational damage to America due to this double standard is incalculable. But then, it just does not care!

Image source: Internet

Edited by Fang Fang

proofread by Wang Yan