Written by:

Dr. HO Chi-Ping, Patrick

Dr. LUFT, Gal

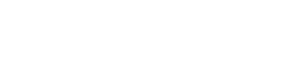

American sanction, be it primary or secondary, is actuated in the international market through excommunication from the financial settlement system. And the main battle was fought over SWIFT.

Image Source : Internet

SWIFT, the Society for Worldwide Interbank Financial Telecommunication, is a global provider of financial messaging services. It is based in a tiny city of La Hulpe in Belgium. Its executive staff and 25 board members are bankers, mostly European. Since its establishment in the 1970s, SWIFT created the standards that allow its registered banks, more than 11,000 of them worldwide, to transfer and exchange money and wire information under one unified platform. Contrary to common perception, SWIFT has nothing to do with the actual transfer of the funds. At no point in the international flow of money does SWIFT touch any money. SWIFT merely authenticates the identity of the sending and receiving banks, clearing the road for the transfer to take place.

As a hub of information about international money transfers, SWIFT has become an important tool in the global fight against money laundering and terrorist financing. Its data is often used by U.S. authorities to gain information on sanctions violators.

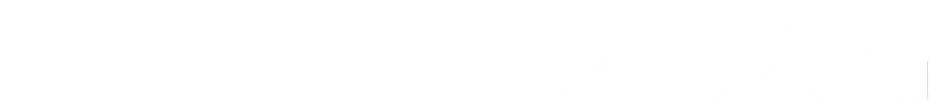

Image Source : Internet

In 2012, when the United States placed Iran under severe sanctions, and with the EU still seeing eye to eye with the US on the same issue, SWIFT disconnected Iranian banks from its system, essentially cutting them off from the global financial system. But in 2016 with the signing of the Iran nuclear deal, also known as the Joint Comprehensive Plan of Action (JCPOA), most of the Iranian banks were reconnected back to the network. But then US President Trump’s unilateral decision to withdraw from JCPOA in May 2018 created a rift between Washington and most of its allies, not to mention Russia and China who were also signatories to the deal. What rattled them was perhaps not so much about the breaking of the agreement without a clear proposed alternative, but the economic punishments Washington promised to apply against those who refused to follow its dictate. This US revocation of the prior agreement brought SWIFT back to the center of the debate.

Most controversial was Washington’s demand that all oil purchases from Iran be terminated by November 5, 2018. The goal, as Secretary of State Mike Pompeo described it, was “to deprive the regime of the revenues that it uses to spread death and destruction around the world” and to compel it “to permanently abandon its well-documented outlaw activities and behave as a normal country.”

Image Source : Internet

Failure to comply with America’s new sanctions would expose the violating entity to secondary sanctions. Any financial institution, corporation or individual that would insist on doing business with Iran would risk being shut off from the American market.

The decision unsettled Iran’s top oil consumers: India, China, Japan, South Korea, Turkey and the EU. On the surface, almost all of them seemed to comply with the US imposed sanctions, but below the surface some took measures to get around them.

India and China shifted their oil purchases to rupees and yuans. European leaders, who as it is have deep antipathy toward Trump for many other reasons, announced the creation of a “special payment entity” to shield European oil purchasers from U.S. sanctions.

Image Source : Internet

The Trump administration demanded that SWIFT disconnect Iran’s banks again in 2018, but SWIFT, this time with the backing of the EU, China and Russia, declined. Washington then made it clear that SWIFT would be subject to U.S. sanctions should it decide to keep Iran connected. It also hinted it might ban SWIFT board members—all reputable international bankers—from working in the U.S. financial system if they helped Iranian banks defy U.S. sanctions. The threat brought SWIFT to its knees, and worked.

But a month after SWIFT disconnected Iran’s banks from its system, it was back in the news. This time it was Russia that was in Washington’s crosshairs. On December 6, 2018, a maritime clash between Russia and Ukraine in the Sea of Azov brought the U.S. Special Representative for Ukraine Negotiations Ambassador Kurt Volker to threaten to cut Russia off from SWIFT. It was not the first time such a threat was made. In fact, the head of Russia’s second-largest bank VTB, Andrei Kostin, once said this would be tantamount to an “act of war.”

Image Source : Internet

The threat of being banned from SWIFT was also applied against China in 2017 by U.S. Treasury Secretary Steven Mnuchin who announced that Beijing’s failure to follow the United Nations sanctions on North Korea would result in preventing its access to the U.S. and international dollar system.

Washington’s treatment of SWIFT as its own fiefdom has drawn the ire of many countries, leading to various efforts to introduce a competing system which is not subservient to U.S. arm twisting.

Hence, in September 2018, Russia began to connect hundreds of its top companies, including its state-owned companies Gazprom, Rosneft etc. to a homemade Russian equivalent of SWIFT called System for Transfer of Financial Messages (SPFS).

Image Source : Internet

Displeased with Washington’s hardnosed approach, the EU also entertained creating a new SWIFT. German Foreign Minister Heiko Maas said: “It’s essential that we strengthen European autonomy by establishing payment channels that are independent of the U.S., creating a European Monetary Fund and building up an independent SWIFT system.”

China too offers an alternative. Back in 2015, partly in response to reports originating from former NSA contractor Edward Snowden that the National Security Agency (NSA) was monitoring SWIFT traffic, the Chinese government introduced the Cross-border Interbank Payments System (CIPS) as an alternative protocol. CIPS is today a backup network for settling mainly trade-related deals in yuans although several Russian banks have already joined the platform.

Image Source : Internet

Although today, CIPS and SPFS are still nowhere near becoming as widely used as SWIFT, the fact that there are already at least two mechanisms in place, in Shanghai and Moscow, to enable members of the de-dollarization movement to transact among themselves at will outside of U.S. jurisdiction, makes clear an important reality about American sanctions: major powers cannot be bullied and pushed around like minor ones. When they are, they push back, and hard! And it will be at the peril of the Big Bully!

Edited by Fang Fang

proofread by Wang Yan